As Arizona’s bioindustry organization, AZBio represents over 200 organizations across Arizona’s healthcare and lifescience community. Battelle estimates that Arizona’s bioscience sector represented over 99,000 employees in 2011.

One of our key roles, as the voice of Arizona’s bioscience industry, is to monitor, research and understand the impact key issues that are bioscience related have on our state and to share that information with industry leaders and policy makers.

Last December, at the 2012 Trailblazer Awards, AZBio shared with leaders across Arizona that due to new impacts of Federal legislation, the processes regarding Biosimilars will be shaped at the state level. AZBio will work with our industry partners and the health care community across the three D’s (Discovery, Development, & Delivery) to insure that Arizona is a leader in legislation that provides for both high levels of patient safety and affordable access to life saving innovations.

Thanks to the leadership of Senator Kelli Ward and others in the Arizona Senate, SB1438: prescription orders; biological products;substitution was introduced this year and has been making its way through the Senate. It has also become a topic of hot debate. There has been SO much debate that it just might be the most talked about bill in Arizona this year.

Key aspects of the AZ biosimilars bill include:

- Only an interchangeable biosimilar can be substituted.

- Physicians retain the right to use “Dispense As Written”.

- Patients are notified of the substitution.

- After the substitution has been made, the pharmacist must send the substitution information to the physician within 72 hours.

- The pharmacist must maintain the record for 7 years just as we do with generic drugs.

Key Definitions:

A debate is defined as a formal discussion on a particular topic in a public meeting or legislative assembly, in which opposing arguments are put forward.

This debate is focused around biological products and specifically the process of how “interchangeable biosimilar” products could be substituted by a pharmacist in Arizona. Since these are not terms that all of us use every day, the FDA provided a simple FAQ for consumers to clarify the definitions.

Key FAQs:

Question: What can you share with us about SB1438?

As part of the Affordable Care Act, the Federal Government created two new definitions of drugs “Biosimilars” and “Interchangeable Biosimilars”.

The term biosimilar refers to products that are marketed after expiration of patents, which are claimed to have similar properties to existing biologic products. Due to the complexity of biologics (they are manufactured using living organisms as compared to traditional pharmaceuticals which are chemical compounds that are combined) a biologic product can only be made that is similar, but not identical as generic drugs are.

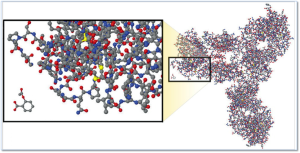

Molecular Comparison:

Aspirin vs. Biologic Monoclonal Antibody

Source – New England Journal of Medicine, “Developing the Nation’s Biosimilars Program,” August 4, 2011

The image at right illustrates the comparative complexity of the most popular small molecule drug (aspirin) which is the small moleucar structure in the lower left of the image and a monoclonal antibody (large molecule /biologic product).

It will be up to the FDA to determine if a product is a biosimilar or if a product is so close to the original biologic that it is an interchangeable biosimilar. The FDA is working on this with industry now. There are currently no biosimilars or interchangeable biosimilars approved by the FDA and on the market.

While the Federal government may review, approve and designate the class of these products, the states will each determine the process for substitution through each state’s Pharmacy Act. That is one of the reasons why this bill is important. Pharmacists in Arizona will not be authorized to substitute these products (and save both patients and payers money) without the prescriber changing the prescription until we update our Pharmacy Act.

Question: What does SB1438 do?

It establishes the process of how these interchangeable biosimilars may be automatically substituted by pharmacists AFTER the FDA has approved them as interchangeable biosimilars and the products are available on the market. If we do not have a process in Arizona, there can be no substitution here without it being approved by the prescribing medical professional. Substitutions will still be possible, however only after either the pharmacist or the patient goes back to the prescriber for a new prescription. This extra step will result in more work for the pharmacists and delays for the patient or the patient’s caregiver.

It does NOT …

- limit access by prescribing medical professionals. The day these drugs are available, they can be prescribed for patients.

- require intervention by the prescribing medical professional before a substitution is made.

- indicate that one product is better or worse than the other.

- require a substitution to occur.

- make any changes to how we handle the automatic substitution of generic drugs

- set pricing in any way

- require ANY state or federal funding

Question: When will these products be available and why do we need this bill now?

We do not know exactly when the products will be available but we expect that we will begin to see the FDA begin to approve them in 2014 or 2015. Acting now establishes the process to allow substitution as soon as they are available. It also provides a guide to the many software companies that are supplying Electronic Health Record and ePrescription programs to the health care delivery community so that they can have adequate time to update their software instead of scrambling with updates at the last minute.

Question: Do you support SB1438?

Yes, the Arizona Bioindustry Association does support SB1438. We believe it is important for both patients and payers to have the benefit of the pharmacist being able to substitute the less expensive interchangeable biosimilars as soon as they are available. We also know that the practice of medicine and patient care is an art of managing many variables. A slight variation can result in a patient responding better or less favorably to any method of care. Even the closest products, the interchangeable biosimilars, will have some slight variations and could react differently with individual patients. For this reason we believe that it is critically important that information flow back to the prescribing medical professional and into the patient record whenever one of these interchangeable biosimilar products are substituted.

Question: If SB1438 does not pass this year, is it a dead issue?

No. Similar legislation will need to be back next year. Until Arizona updates its Pharmacy Act, there is no process for biosimilar substitution and there needs to be. This year, hundreds of hours have been invested by organizations, legislators and lobbyists as information was shared on this issue. If SB1438 does not pass at this time, the whole cycle (and the many hours of investment in debate and discussion) starts all over again.

This same legislative process is currently ongoing in 20 other states. Virginia is the first state to enact legislation.

Question: I have heard that this is just a battle between a handful of big companies over the issue. Is this true?

There are definitely big companies on both sides of this debate. They include global pharmaceutical and biologics companies, national pharmacy chains, and pharmacy benefit managers.

BUT, they are not the only stakeholders. Physicians, patients, health care advocates and many others are also key stakeholders. The many groups supporting SB 1438 are a good illustration of how widely diverse this group is and how important SB1438 is to our community.

ORGANIZATIONS IN SUPPORT OF SB 1438

Pharmacist Substitutes Interchangeable Biosimilars

and Notifies Physician and Patient of Substitution

AbbVie

Access Architectural

Allergan

Alliance for the Adoption of Innovations in Medicine

Alliance for Safe Biological Medicines

American Academy of Facial Plastic and Reconstructive Surgery

American Academy of Dermatology

American Association of Neurological Surgeons

American College of Mohs Surgery

American Gastroenterological Association

American Society of Cataract and Refractive Surgery

American Society of Echocardiography

American Society of Plastic Surgeons

American Urological Association

Amgen

Arizona BioIndustry Association

Arizona Latin-American Medical Association

Arizona Medical Association

Arizona Osteopathic Medical Association

Arizona Wellness Community – an affiliate of the Cancer Support Community

Biotechnology Industry Organization

Coalition of State Rheumatology Organizations

Congress of Neurological Surgeons

Eli Lilly

Genentech

GlaxoSmithKline

Global Healthy Living Foundation

Greater Phoenix Urban League

Healthy Mother Healthy Babies of Maricopa County

International Cancer Advocacy Network

International Myeloma Foundation

Johnson & Johnson

Kidney Cancer Association

MedImmune

Merck

Mobile Onsite Mammography

National Association of Hispanic Nurses – Angeles del Desierto Chapter

North American Spine Society

Pharmaceutical Research and Manufacturers of America (PhRMA)

Sanofi

Society for Cardiovascular Angiography and Interventions

Society for Excellence in Eyecare

Takeda

TechNet

The Alliance of Specialty Medicine

The Arizona Clinical Oncology Society

UCB

_________

About the Author:

Joan Koerber Walker serves as the President and CEO of the Arizona Bioindustry Association (AZBio), a member of the Council of State Bioscience Associations, and the Council of State Bioscience Institutes. She is also the mother of a patient with Crohns Disease and the patient advocate for her son. Biologics (and in the future perhaps biosimilars) are used to help patients with Crohn’s lead normal and productive lives. In addition to leading AZBio’s research efforts on this subject, she has first hand experience working with biologics manufacturers, physicians, specialty pharmacies, pharmacy benefit managers and other members of the healthcare delivery system.

Contact the Author:

480-332-9636 email