What will it take to take the Arizona biotech industry to the next level in the coming decade?

Reaching the heights of bioscience industry success requires a solid foundation in research, a supporting capital infrastructure, and a concentration of companies with the ability to scale.

Last week, at luncheons held across the state, the Flinn Foundation unveiled the results of the Arizona Bioscience Road Map to leaders from academia, industry and government.

With bioscience jobs (including hospital jobs) growing at 4 times the national average over the decade from 2002 – 2012, we have made considerable progress, but we have more to do.

“Arizona’s bioscience sector continues to significantly outperform the nation in terms of job and establishment growth and has made impressive gains in building a more concentrated industry base,” said Walter Plosila, senior advisor to the Battelle Technology Partnership Practice. “However, more attention must be paid to academic research performance and venture capital investment to continue the trend in years to come.”

The last decade was one of great success in laying a foundation for Arizona’s bioindustry, but now a framework must be built on that foundation to create an industry that has both critical mass and adequate capital for continued growth if we are to move from being a fast growing “up and comer” to a national leader.

Research will always be a key focus the foundation that we build upon.

Arizona has made substantial investments in research infrastructure over the last decade through both creation and expansion including: BIO5, The Biodesign Institute, TGen, TGen North, IGC, the Arizona Cancer Institute, Barrow Neurological Institute, Phoenix Children’s Hospital, and Science Foundation Arizona. To continue our growth rate, we must continue to support the investments we have made in this area in both institutional infrastructure and in attracting and retaining the talent that works within its walls.

Capital provides the super structure.

Just as research is the foundation, investment provides the support infrastructure that allows us to build ever higher. Over the last decade, over $8 Billion in public sector and private sector investments have flowed through the Arizona bioindustry sector, much of it into both infrastructure development and research funding. Venture capital, as reported by Battelle, was just $560M for the 10 year period. Examples of acquisitions of Arizona companies by global industry players include: Ventana by Roche ($3.4B), Abraxis by Celgene ($2.9 B), Selectide by Marion Merrell Dow (now Sanofi US), Intrinsic Bioprobes by Thermo Fisher, MPI by Caris Diagnostics, and several acquisitions by Stryker in both Phoenix and Tucson.

This all sounds good but…

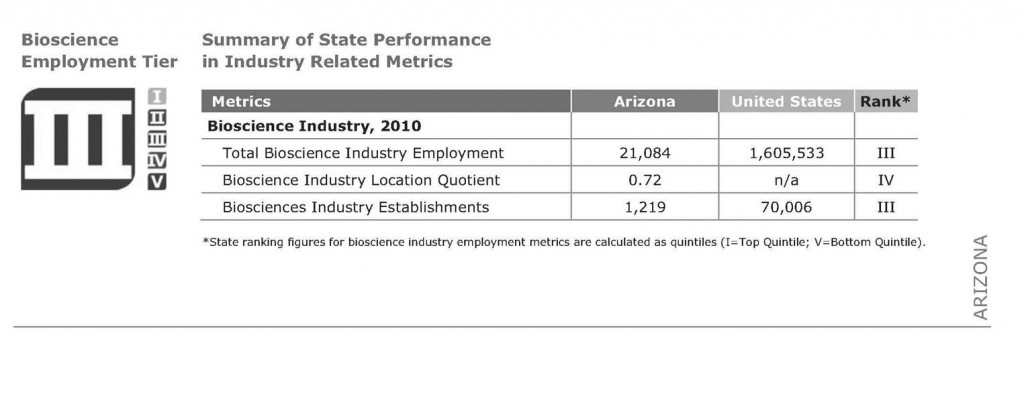

While Arizona has made significant progress over the last decade, we have a ways to go to make our way into the realm of Tier I bioscience states when we take hospital employment out of the mix according to the latest rankings published by the Biotechnology Industry Organization (BIO) in June of 2012.

Note: Arizona Bioscience Employment (including hospitals) in 2011 equaled 99,000+ according to Battelle.What will it take to move from the middle of the rankings to the top tier?

Reaching the heights of bioscience industry success requires a solid foundation in research, a supporting capital infrastructure, and a concentration of companies with the ability to scale. Research and discoveries provide the critical foundation, but it is companies engaged in both development AND delivery of products and services that provide the impetus for scalable and sustainable growth.

We are often reminded that building a bioscience industry takes time. Tier I markets including Boston, the Bay Area, Research Triangle, and San Diego all started with focused investments and were anchored with innovator companies decades before we embarked on our quest a decade ago. While this is true, it also gives us the advantage of looking at what drove their growth and strategically investing to accelerate our own growth process.

In July of 2012, the Biotechnology Industry Association (BIO) published a series on Building Biotech Hubs; Biomanufacturing Attractors and Accelerators. While the study and recommendations centered specifically for the manufacturers of biologics, these same drivers can be applied equally to our diagnostics and medical device sectors. Based on research from across the states, they compiled a list of 10 best practices for both attraction and acceleration. They are listed below with a measure of where we are in Arizona today.

10 State and Regional Factors for Biomanufacturing Clustering and Success: (Source: BIO.org)

1. Availability of tax breaks, grants, finance, loans, guarantees (Nature of loan, grant and tax break packages)

While Arizona has moved forward in this area with programs approved by the Legislature and administered through the Arizona Commerce Authority and Science Foundation Arizona, we have been mostly maintaining parity or catching up with other biotech states, not gaining a significant competitive advantage. To change the game and take the advantage, we must create a new and innovative strategy to improve our access to capital if we are to attract and retain high growth biotech firms.

2. Infrastructure (transport, communications, utilities) Road access, air freight handling, water, broadband facilities)

Here Arizona has a distinct advantage. As a young state (celebrating 100 years in 2012), Arizona’s technology infrastructure is fresh compared to neighboring states, includes a major international airport, and has utility rates that are highly competitive.

3. Availability of skilled workforce technicians (Bioprocessing technicians, relevant training organizations )

In the early days, this was Arizona’s greatest weakness. Today, Arizona has begun to build its talent base, but on a too frequent basis we lose that talent to other regions when they must look for jobs elsewhere after graduation. At the same time, many biotech and medical device companies need experienced talent, not just recent grads. Our opportunity lies in creating a Biotechnology and Health Care Center of Excellence that links Arizona educational institutions at all levels more closely with Arizona biotech employers so that we are providing on the job training in the skill sets needed today and integrating students prior to graduation.

4. Cost of labor (New hires, out-of-state recruitment costs)

When talent is local, Arizona has a distinct wage advantage over other leading biotech regions due to our lower cost of living. When talent needs to be imported, the costs can be prohibitive, especially for the emerging biotech sector. Thus, creating a Biotechnology and Health Care Center of Excellence that develops an industry specific trained talent pool is essential.

5. Availability of biomanufacturing workers (Local graduate training programs : Existing talent pool in cluster)

Our three State Universities (NAU, ASU, and UA) are well positioned to provide talent for the growing industry. Today we are exporting talent to other states. As the industry grows locally, we can better deploy talent locally. By creating a Biotechnology and Health Care Center of Excellence to train and match talent to current and future industry needs, we can better project the skill sets that will be needed and balance our talent pool.

6. Planning environment and business support assistance (Integrated, professional services to assist operations)

Arizona’s Bioscience Road Map is the longest running fully integrated and progress monitored bioscience sector development strategy in the U.S. Connecting over 100 leaders from across the state and within academia and industry along with state and local government leaders, economic development specialists, and industry associations, the Road Map Steering Committee creates a integrated and connected leadership environment.

7. Effective sector networks (Industry-led networks related to biomanufacturing issues)

In addition to collaborations born of the Road map Steering Committee, the Critical Path Institute (C-Path) works in the pre-competitive research space. Based on Tucson and active globally, C-Path orchestrates the sharing of data and knowledge among industry, government, patient advocacy groups, and academia. C-Path then engages the active participation of regulatory authorities (FDA, EMA, and others) with the goal of creating efficiencies and speeding products to market.

8. Existing companies in a region

Arizona’s biotech production sectors are strongest in the areas of medical devices, testing/diagnostics, genomic based therapeutics and global anchors include:

- Medical Device Sector: W.L. Gore, Medtronic, and Bard

- Diagnostics – Ventana Medical Systems, Inc., a member of the Roche Group

- Therapeutics – Sanofi U.S. and Celgene

The overall number of firms (establishments) has grown 31% over the last decade with the greatest growth in the non hospital sector.

9. Proximity of clients and partners

Arizona’s “Sun Corridor” stretches from Flagstaff in the North to Tucson in the South. At it’s center is Phoenix, the 6th largest city in the United States. The Sun Corridor is home to close to 6 million people today and is projected to double in population by the year 2040. While Arizona’s bioindustry’s company concentrations are still slight in each industry sub-sector, it is also strategically located just a short plane flight way from Denver, Salt Lake City, Southern California and Northern California which provide for a much stronger combined density.

10. Presence of key suppliers

Concentration of suppliers is directly related to the concentration of buyers. Arizona’s medical device supply chain is more developed than those of the diagnostics and therapeutic sectors. However, proximity to concentrated centers in California provide reasonable access in most cases and will likely develop further as the industry concentrates.

Of the 10 key attractors and accelerators, our greatest needs in the coming decade will be in the areas of both growth capital and specialized talent. Our challenge, and our opportunity, will come in addressing these needs in new and creative ways that both support our existing base and attract new additions. With solutions in these areas, we will naturally develop the critical mass that will be the hallmark of this new decade.