The IMS Health Holdings (NYSE:IMS) IPO represents the second-biggest IPO so far this year in the U.S.

IMS Heath’s IMS One portfolio of products includes 360 Vantage|IMS Health (Chandler, AZ). 360 Vantage was acquired by IMS Heath in May of 2013.

TPG Capital Management-backed IMS Health Holdings Inc’s initial public offering was priced at $20 per share, a market source said, valuing the healthcare information company at about $6.64 billion.

With 65 million shares offered, the IPO raised about $1.30 billion at the offer price, which was slightly above the mid-point of its expected price range of $18-$21 per share. (Source Article: Reuters)

Shares of IMS Health Holdings Inc. (IMS) opened at $22.18 in their trading debut Friday on the New York Stock Exchange, 11% above where the initial public offering had priced. (Source Article: Nasdaq.com)

At the close of first day trading, the stock price was at $23.00.

IMS sold 52 million of the 65 million shares in the offering, and the rest were sold by selling shareholders–the Canada Pension Plan Investment Board and private-equity firms TPG Capital and Leonard Green & Partners LP.

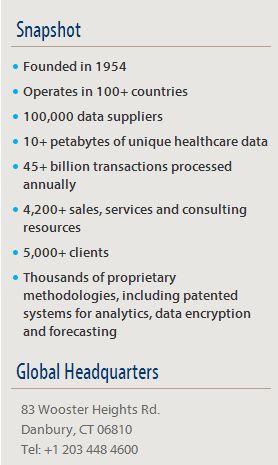

IMS Health is a leading global information and technology services company providing clients in the healthcare industry with comprehensive solutions to measure and improve their performance. By applying sophisticated analytics and proprietary application suites hosted on the IMS One intelligent cloud, the company connects more than 10 petabytes of complex healthcare data on diseases, treatments, costs and outcomes to help its clients run their operations more efficiently. Drawing on information from 100,000 suppliers, and on insights from more than 45 billion healthcare transactions processed annually, IMS Health’s approximately 9,500 employees drive results for healthcare clients globally. Customers include pharmaceutical, consumer health and medical device manufacturers and distributors, providers, payers, government agencies, policymakers, researchers and the financial community.

IMS had $2.54 billion in sales and net income of $82 million in 2013.

In May of 2013, IMS Health acquired 360 Vantage (Chandler, Arizona), a leading provider of cloud-based multi-channel CRM and closed loop marketing technologies, to further extend its commercial Software-as-a-Service capabilities for life sciences and healthcare organizations around the globe. Bringing together 360 Vantage’s best-in-breed technologies with IMS Health’s market-leading healthcare information, analytics, managed services and technology solutions will enable clients to more effectively engage with their customers while reducing overall spend.

360 Vantage solutions became part of IMS One, the company’s commercial platform that combines IMS Health and third-party data for sales, marketing and performance management activities. Flexible and scalable, IMS One provides insights and services through the cloud, enabling clients to benefit from lower costs, faster implementation and increased speed to insight. This acquisition, along with IMS Health’s recent acquisitions of Appature and Semantelli, expanded the company’s growing portfolio of SaaS solutions that help organizations plan, execute and assess customer engagement activities across digital and traditional channels.